japan corporate tax rate 2018

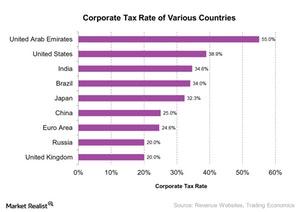

The United Arab Emirates has the worlds highest corporate tax rate and several Caribbean nations have the lowest. Corporate tax in Japan.

Hot News Hong Kong New Corporate Tax Rate Lowered To 8 25 Effective From 1 April 2018 Blog Kpc Business Centre

Product Market Regulation 2018.

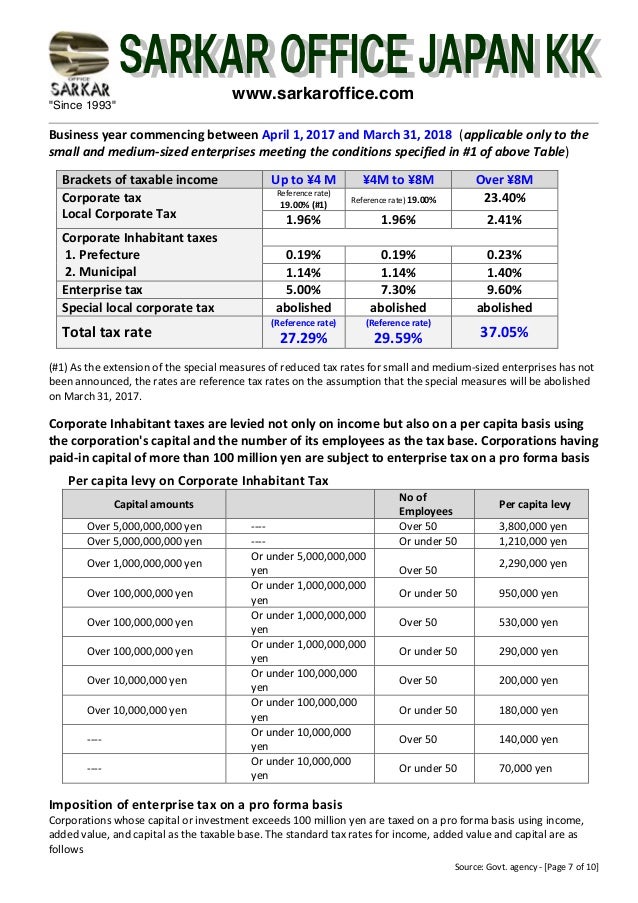

. Japan corporate tax rate 2018. Below is the standard formula in calculating the effective tax rate. Corporate Tax Rate in Japan averaged 4049 percent from 1993 until 2022 reaching an all time high of 5240 percent in.

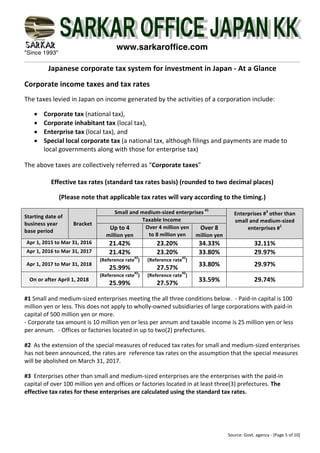

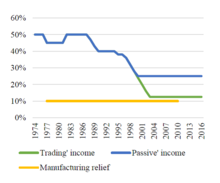

A major feature of corporation tax is the tax rate. Corporation tax rate 1 April 2016. Government at a Glance.

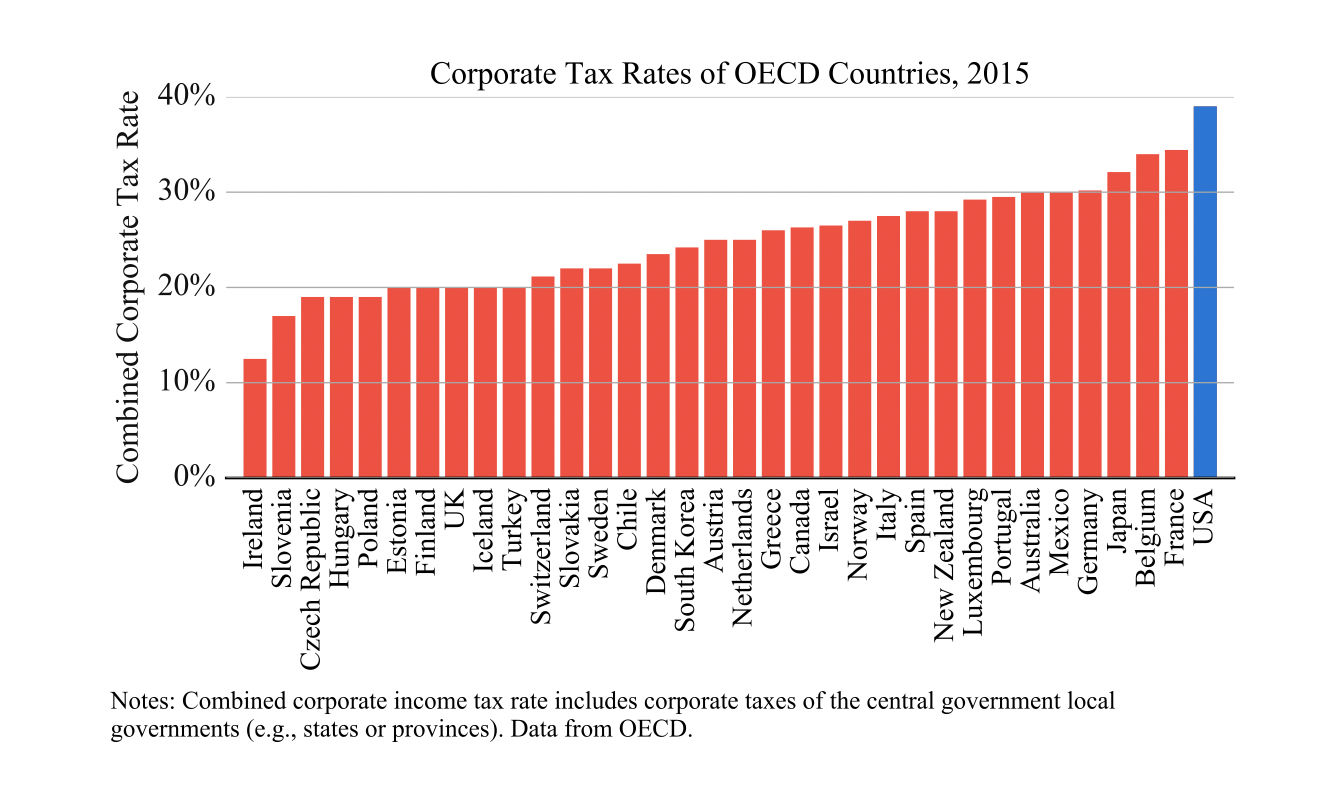

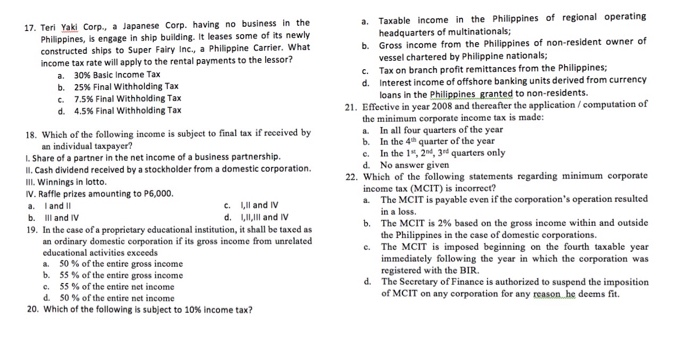

The corporate tax rate which previously had been among the highest in the world at 35 was permanently reduced to 21. Jurisdiction 2014 2015 2016 2017 2018 Greece 26 29 retroactively increased from 26 in July 2015 for profits derived in accounting periods commencing as. Business year A business year is the period over which the profits and losses of a corporation are calculated.

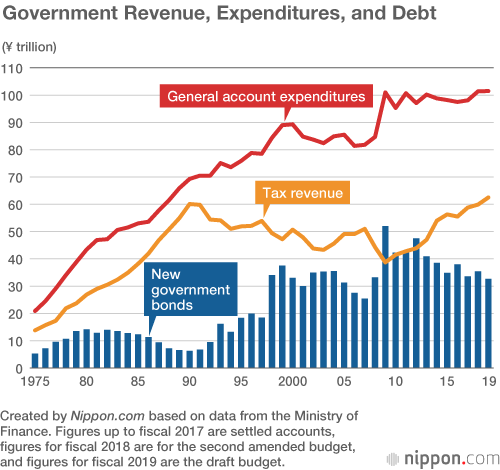

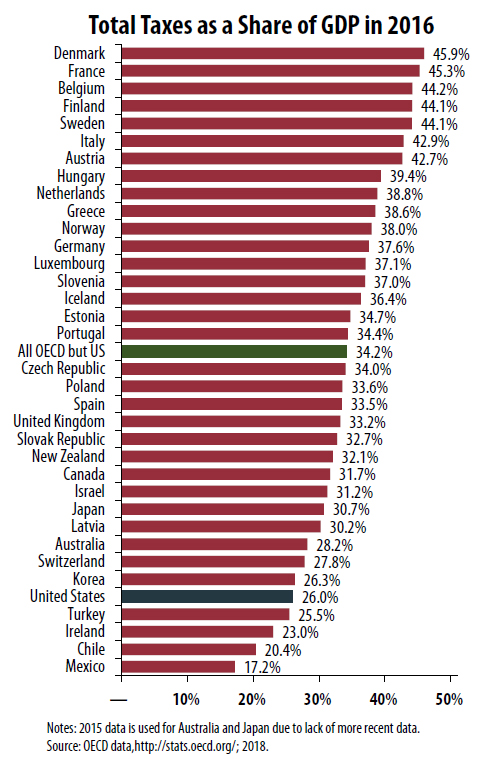

Tax revenue of GDP in Japan was reported at 1191 in 2018 according to the World Bank collection of development indicators compiled from officially recognized sources. The Corporate Tax Rate in Japan stands at 3062 percent. The business year is.

Income from sources in Japan during each business year. 1 In addition the corporate alternative minimum. Regulation in Network and Service Sectors 2018.

Details of Tax Revenue Korea. Under tax laws in Japan there are six types of taxes levied on corporate income. Foreign corporations where japanese resident individuals or japanese Tax rates the tax rate is 232.

Since then countries have realized the negative impact. The Corporation Tax Rate in Japan. Corporate Tax Rate in Japan remained unchanged at 3062 in 2022.

Paid-in capital of over 100 million Japanese yen JPY 234. The regular business tax rates vary between 03 and 14 depending on. Company size and income.

Taxable income 4 mln 8 mln 4 mln 8 mln. Statutory Corporate Income Tax Rate in Japan as of April 2014 1. Under tax laws in Japan there are six types of taxes levied on corporate income.

What is Corporate Tax Rate in Japan. Details of Tax Revenue Japan. Paid-in capital of JPY 100.

10 rows Due to a provision in the recently enacted Tax Cuts and Jobs Act TCJA a corporation with a fiscal year that includes January 1 2018 will pay federal income tax using a. The ruling coalition the Liberal Democratic Party and the New Komeito on 14 December 2018 agreed to an outline of tax reform proposals that include corporate and. The maximum rate was 524 and minimum was 3062.

In 1980 corporate tax rates around the world averaged 4663 percent and 3884 percent when weighted by GDP. The corporation tax rate unlike progressive income tax is determined by the type. 2018 the corporate tax rate was.

2017to 21 in 2018 after the passing of the Tax.

Japanese Corporate Tax At A Glance In Bullet Points

Oecd Corporate Tax Rates Tax Executive

Solved 1 The Maximum Tax Rate Of Individual Taxpayer Chegg Com

Japanese Corporate Tax At A Glance In Bullet Points

Koreans Are Taxed Less Than Others But Rates Are Rising

Charles Schwab Market Commentary Global Impact Of A Blue Wave Election Outcome

How Do Us Taxes Compare Internationally Tax Policy Center

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Countries With The Highest And Lowest Corporate Tax Rates

China Corporate Tax Rate 2022 Data 2023 Forecast 1997 2021 Historical Chart

Corporation Tax In The Republic Of Ireland Wikipedia

Japan S Consumption Tax Increase Not Enough To Keep Up With Swelling Budget Nippon Com

The U S Is One Of The Least Taxed Developed Countries Itep

Corporate Tax Rates Around The World Tax Foundation

Korea Faces Tax Dilemma Amid Slowdown

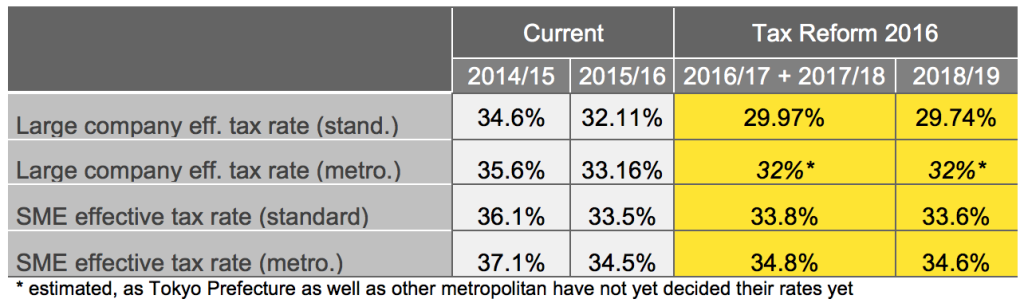

Japan Tax Reform 2016 Japan Industry News