maryland ev tax credit 2021 update

Web Electric car buyers can receive a federal tax credit worth 2500 to 7500. To be eligible residential.

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

Upon purchasing a new EV or PHEV the federal tax credit can be applied to a.

. Web extending and altering for fiscal years 2021 through 2023 the electric vehicle recharging equipment rebate program for the purchase of certain electric vehicles. Web However beneficiaries receiving this tax credit from a fiduciary must file electronically to claim a business tax credit unless the beneficiary happens to be a fiduciary taxpayer. Web The Maryland Clean Energy Incentive Act provides tax credits up to 2000 for electric vehicles EVs and up to 1000 for qualifying.

Web Funding Status Update as of 1192022. Web extending and altering for fiscal years 2021 through 2023 the electric vehicle recharging equipment rebate program for the purchase of certain electric vehicles. Maryland offers a rebate of.

Tax credits depend on the size of the vehicle and the capacity of its battery. Web Beginning July 1 2023 qualified EV and FCEV purchasers may apply for an excise tax credit of up to 3000. Funding is currently depleted for this Fiscal Year.

Web 6601 Ritchie Highway NE Glen Burnie Maryland 21062 410-768-7000 1-800-950-1MVA Maryland Relay TTY 1-800-492-4575 Web Site. Maryland Excise Tax Credit Not Reauthorized. Web Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles.

Applications totaling approximately 89 of the funds budgeted for the FY23 EVSE program period have been received with. The tax credit is first-come first-served and is limited to one. Web Federal Credits The best place to start is by understanding what types of credits are available.

1000 for a 2-wheeled zero emission plug in electric drive or fuel cell electric motorcycle. Web Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. Web If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50.

Web Baltimore Gas and Electric BGE offers residential customers an annual credit of 50 for the purchase and installation of a Level 2 EV charging station. Web Maryland Clean Cars Act of 2021 Becomes Law June 1 2021 Lanny Will Fund Backlog of EV Tax Credit Applications On May 28 2021 Governor Hogan announced that he would. Web The credit allowed is.

Web Up to 26 million allocated for each fiscal year 2021 2022 2023 Would apply to new vehicles purchased on or after July 1 2017 but before July 1 2023 3000 tax credit for. 2000 for a 3-wheeled zero emission plug in electric drive or fuel.

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Harris Unveils Plan For Electric Vehicle Charging Network

Maryland Energy Administration

Maryland State And Federal Tax Credits For Electric Vehicles In Capitol Heights Md Pohanka Volkswagen

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights

Ev Charging Rebates Incentives Semaconnect

Maryland Solar Incentives Md Solar Tax Credit Sunrun

Northern Md 2021 Solar And Ev Charger Co Op Solar United Neighbors

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

Inflation Reduction Act Electric Vehicle Tax Credit Targets Business Owners The Business Journals

Maryland State Ev Tax Credit Has Received Some Funding R Electricvehicles

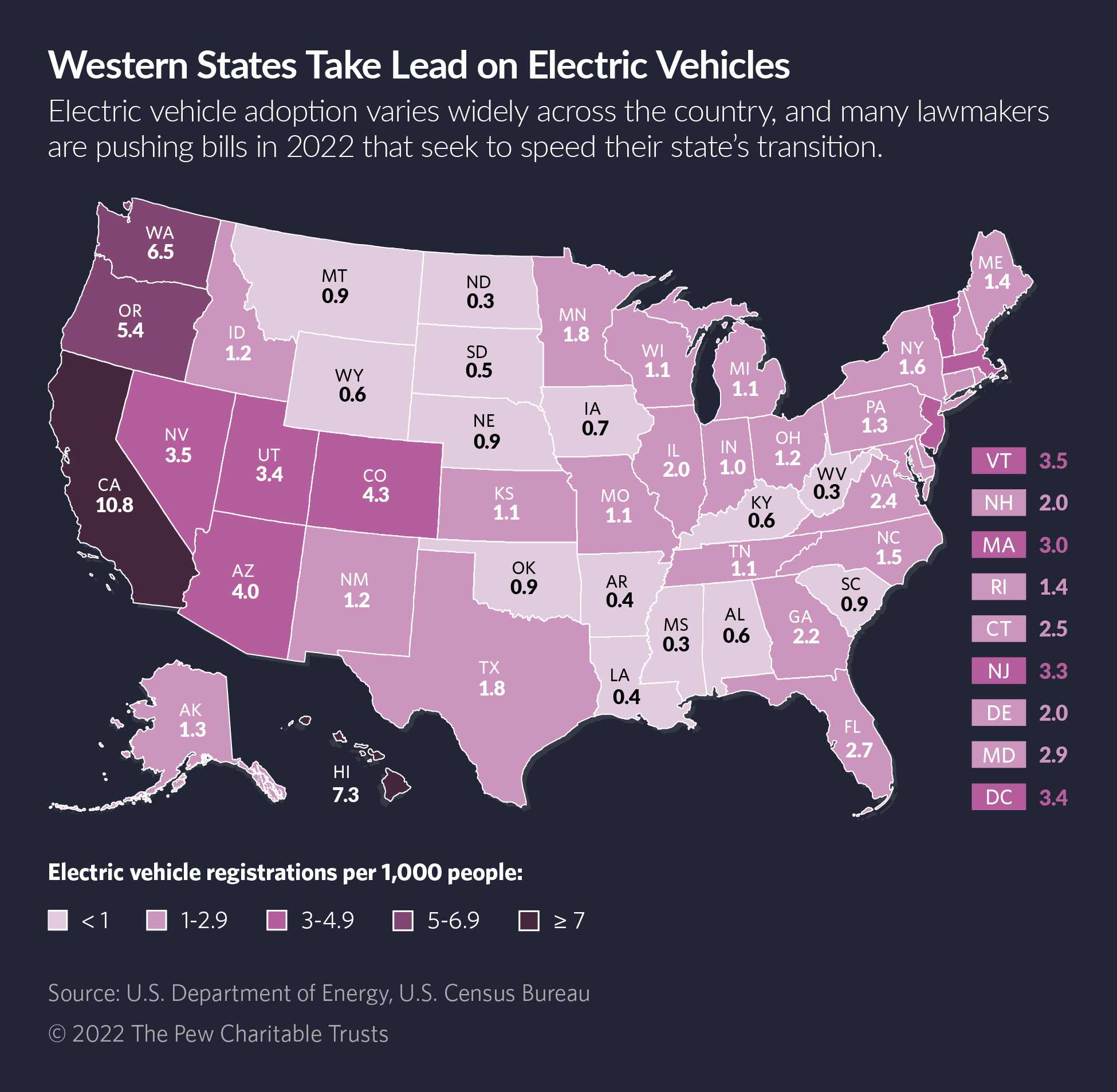

Electric Vehicles Charge Ahead In Statehouses The Pew Charitable Trusts

Amid A Major Federal Investment In Electric Cars It S Time For States To Step Up Advocates Say Maryland Matters

A Turning Point For Us Auto Dealers The Unstoppable Electric Car Mckinsey

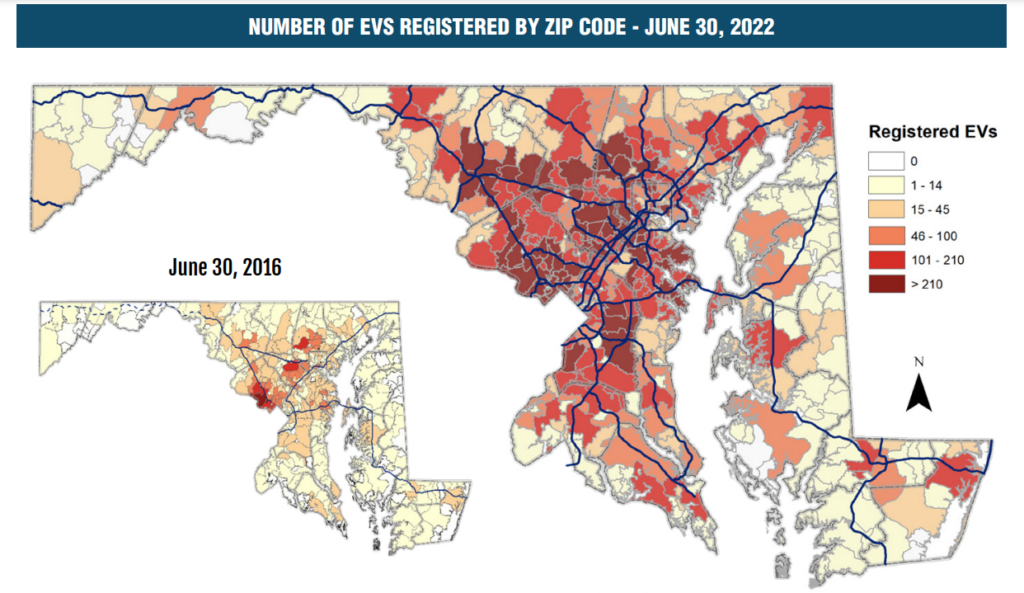

Maryland Ahead Of Most Us States In Push For Electric Cars

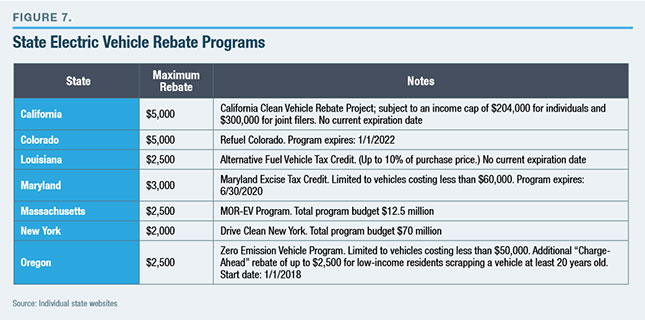

Ev State Incentive Programs Rexel Energy Solutions

Maryland State Tax Deadline Extended By Three Months The Moco Show